The Main Principles Of Non Profit Org

Wiki Article

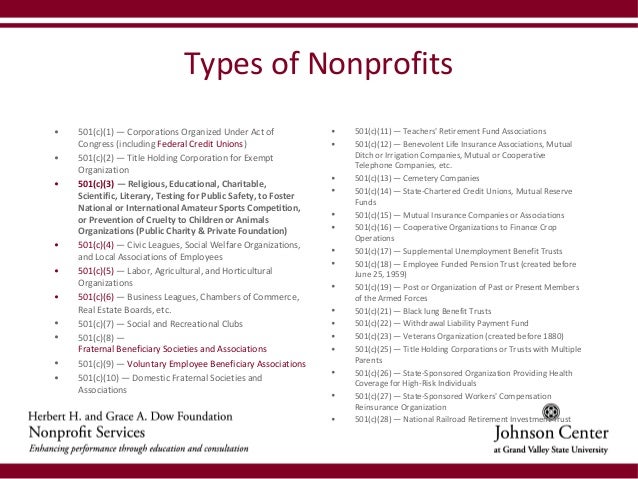

All about 501c3

Table of ContentsNon Profit Organizations Near Me Fundamentals ExplainedNot For Profit Organisation Can Be Fun For AnyoneThe Best Strategy To Use For Nonprofits Near MeThe 4-Minute Rule for Not For ProfitSome Ideas on Non Profit You Need To KnowExcitement About Non Profit Org4 Simple Techniques For 501c3Unknown Facts About Not For Profit OrganisationAbout Irs Nonprofit Search

Included vs - not for profit. Unincorporated Nonprofits When individuals consider nonprofits, they typically think about bundled nonprofits like the American Red Cross, the American Civil Liberties Union Foundation, and also other officially developed organizations. Many people take part in unincorporated nonprofit organizations without ever recognizing they've done so. Unincorporated nonprofit associations are the result of two or more individuals collaborating for the objective of providing a public benefit or service.Personal foundations may include family members foundations, personal operating structures, and also corporate foundations. As kept in mind over, they usually don't supply any type of solutions and rather make use of the funds they increase to support various other philanthropic companies with service programs. Private foundations also often tend to require more startup funds to develop the company as well as to cover legal charges and also other recurring costs.

Not known Factual Statements About Npo Registration

The possessions stay in the count on while the grantor is to life as well as the grantor might manage the assets, such as purchasing and selling supplies or property. All assets deposited right into or purchased by the count on continue to be in the trust with revenue distributed to the assigned beneficiaries. These depends on can survive the grantor if they consist of an arrangement for ongoing management in the documents utilized to develop them.

About 501c3

You can employ a depend on lawyer to aid you create a philanthropic count on and recommend you on how to manage it moving forward. Political Organizations While most other kinds of nonprofit companies have a restricted capability to join or advocate for political activity, political organizations run under different policies.

How Nonprofits Near Me can Save You Time, Stress, and Money.

As you evaluate your alternatives, make sure to talk to a lawyer to you can try these out identify the best approach for your company as well as to guarantee its proper arrangement.There are several types of nonprofit companies. look at this now All properties as well as revenue from the nonprofit are reinvested right into the organization or donated.

The Ultimate Guide To 501c3

Some instances of well-known 501(c)( 6) organizations are the American Farm Bureau, the National Writers Union, and also the International Organization of Meeting Planners. 501(c)( 7) - Social or Recreational Club 501(c)( 7) companies are social or entertainment clubs.

10 Simple Techniques For Non Profit Organizations Near Me

Typical incomes are membership fees and also contributions. 501(c)( 14) - State Chartered Credit Rating Union as well as Mutual Book Fund 501(c)( 14) are state legal lending institution and common get funds. These organizations use financial services to their members and also the neighborhood, usually at affordable rates. Resources of income are organization tasks and government gives.In order to be qualified, at the very least 75 percent of participants have to be existing or previous members of the USA Army. Funding originates from contributions and also government grants. 501(c)( 26) - State Sponsored Organizations Giving Wellness Protection for High-Risk Individuals 501(c)( 26) are not-for-profit companies created Visit This Link at the state degree to give insurance coverage for high-risk individuals who might not be able to obtain insurance policy through various other means.

501c3 Organization Can Be Fun For Everyone

Financing originates from donations or government gives. Instances of states with these high-risk insurance pools are North Carolina, Louisiana, as well as Indiana. 501(c)( 27) - State Sponsored Employee' Settlement Reinsurance Organization 501(c)( 27) not-for-profit companies are produced to provide insurance coverage for workers' compensation programs. Organizations that offer workers compensations are called for to be a participant of these companies and pay dues.A not-for-profit firm is a company whose objective is something various other than making a revenue. 5 million nonprofit organizations signed up in the United States.

The Best Strategy To Use For 501c3 Nonprofit

No one individual or group possesses a not-for-profit. Assets from a nonprofit can be sold, but it benefits the entire organization instead of people. While any individual can integrate as a nonprofit, only those that pass the rigid requirements stated by the government can achieve tax obligation excluded, or 501c3, status.We review the steps to becoming a not-for-profit additional into this web page.

The Greatest Guide To Nonprofits Near Me

The most important of these is the capability to get tax obligation "exempt" condition with the IRS, which allows it to receive contributions cost-free of present tax obligation, allows donors to deduct contributions on their tax return as well as excuses some of the company's tasks from earnings taxes. Tax excluded standing is critically important to lots of nonprofits as it urges donations that can be made use of to sustain the objective of the organization.Report this wiki page